Gen Z’s American Dream: 5 Leg Parlay Your Way to Basic Physiological Needs

Joe McNaney (lawl)

·Sep 5, 2024

Wagecucks, Six-Figure Hell, and the Vibe Shift

Rising house prices, stagnant housing supply, grocery store “price gouging,” money printer going brrr, the gig economy, meme-stocks/coins, and Kevin Hart and Jamie Fox shilling you different sportsbooks to donate your paycheck to at every TV ad break - the new American Dream seems to be some version of “you too are just one five-leg parlay away from being able to consider buying a home.”

What did they do to us?!

Post-COVID & the legalization of online sports betting in many states in the US - you can’t go to a bar without overhearing a group of recent graduates (almost always male) debating which backup Tight End is more likely to catch a touchdown and how much of their net worth they are willing to wager on it. “Mo-Alie-Cox is a lock at +900 bro, dude is 8 feet tall.”

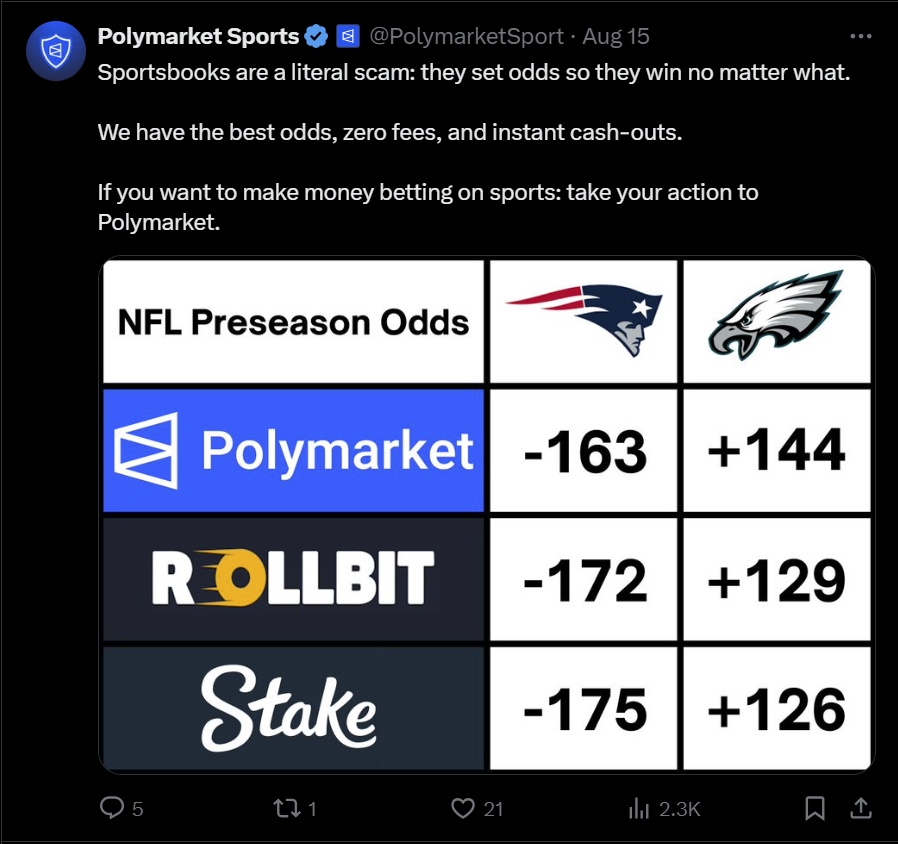

Hyperbolic, to bait engagement, but the tweet below hits particularly hard as the NFL season approaches.

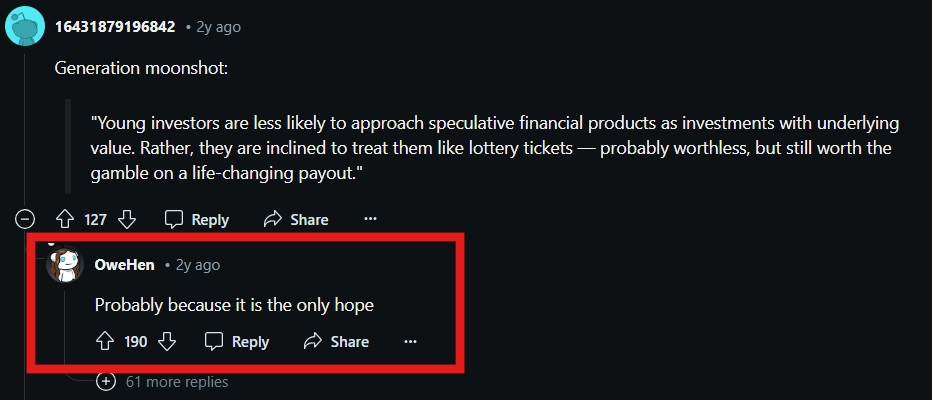

Among young Americans, there is this ever-growing sense of financial nihilism, a trend some brush off as young people not understanding the value of hard work and wanting to get ahead quickly, but for those entering or new to the workforce, nihilism feels like realism.

In response to Reddit user 16431879196842’s question on why young folks are taking such risk with their investments *cough* gambles, Reddit user OweHen responds “Probably because it is the only hope.”

WHAT DID THEY DO TO US?!

The rather depressing reasoning behind the "bet it all" mindset often follows a simple, albeit flawed, loop: 0 is essentially the same as 10,000 but 10,000 is vastly different from 1,000,000 - so you should just work your way up to 10,000 and then bet it all before a home becomes even less attainable.

This reasoning loop creates a sense of control. By betting it all, there’s a belief that you’re actively doing something to change your circumstances, rather than passively accepting the status quo, and even if you lose at least you tried.

On Wealth/Lifestyle Tiers

$0 to $1,000: Food on the Table

The first wealth tier is having enough cash to put food on the table. A lot of gambling takes place at this level. A bit of a what do I have to lose mindset comes into play here.

The below excerpt from Carnegie Melon University in 2008, “Why play a losing game?” remains relevant. Note the emphasis on the words “feel” and “subjective.”

"In the study, published in the July issue of the Journal of Behavioral Decision Making, participants who were made to feel subjectively poor bought nearly twice as many lottery tickets as a comparison group that was made to feel subjectively more affluent. The Carnegie Mellon findings point to poverty's central role in people's decisions to buy lottery tickets."

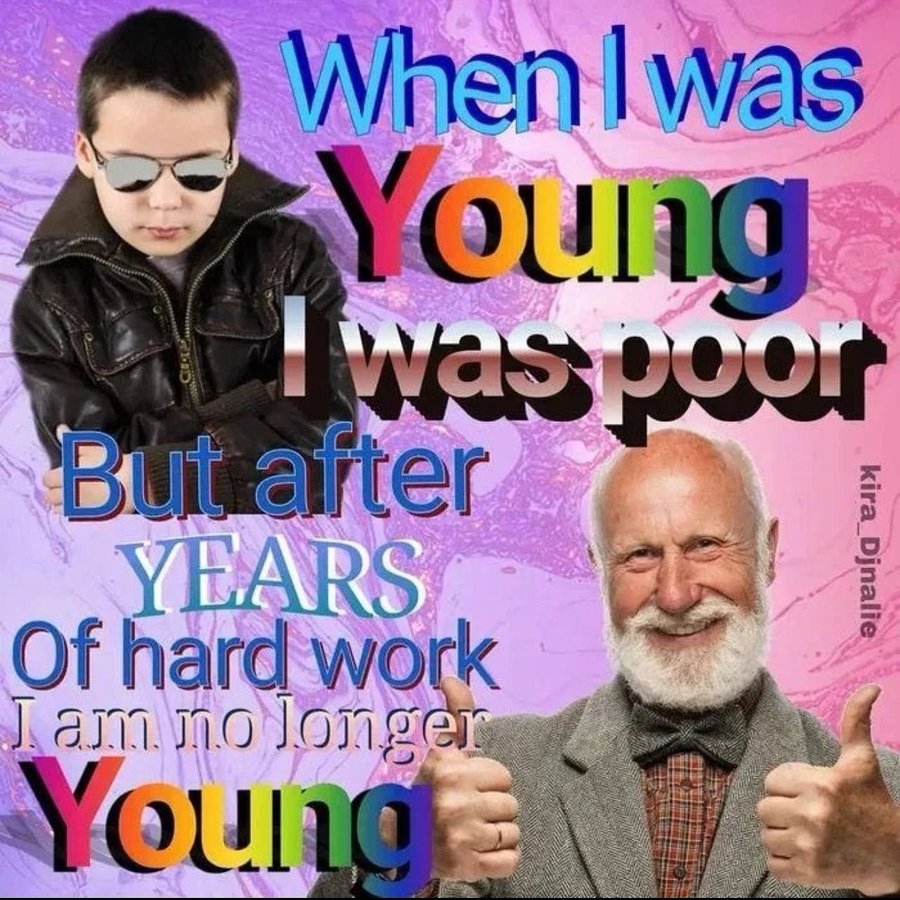

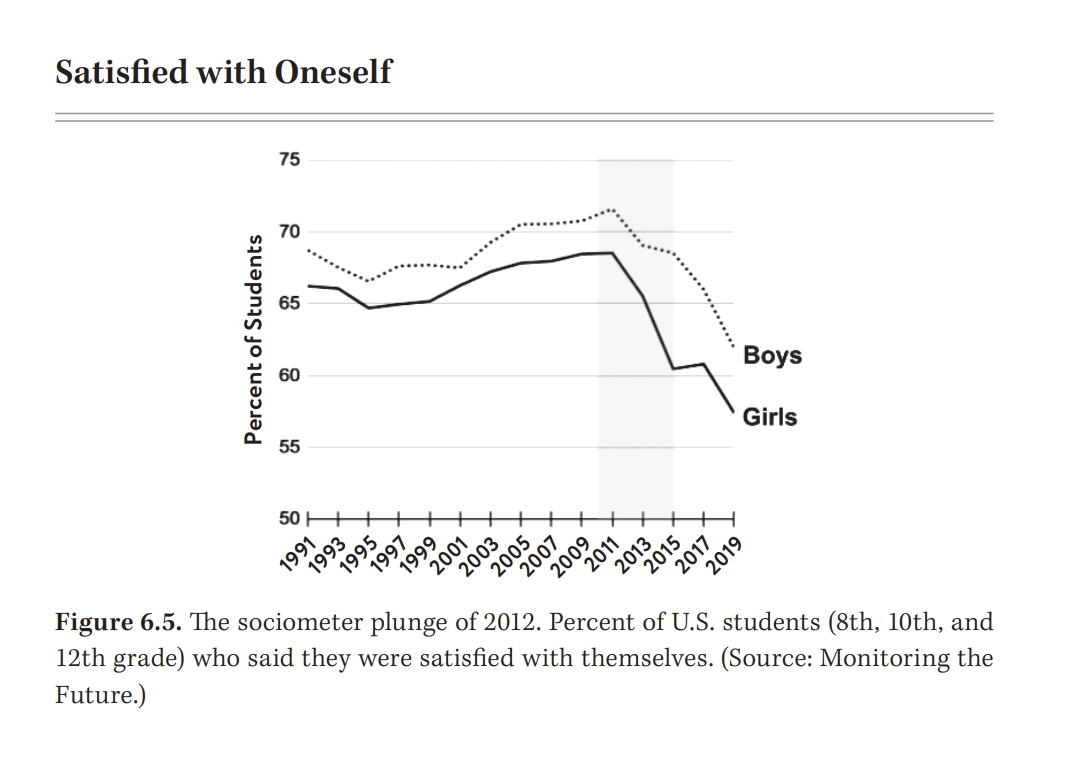

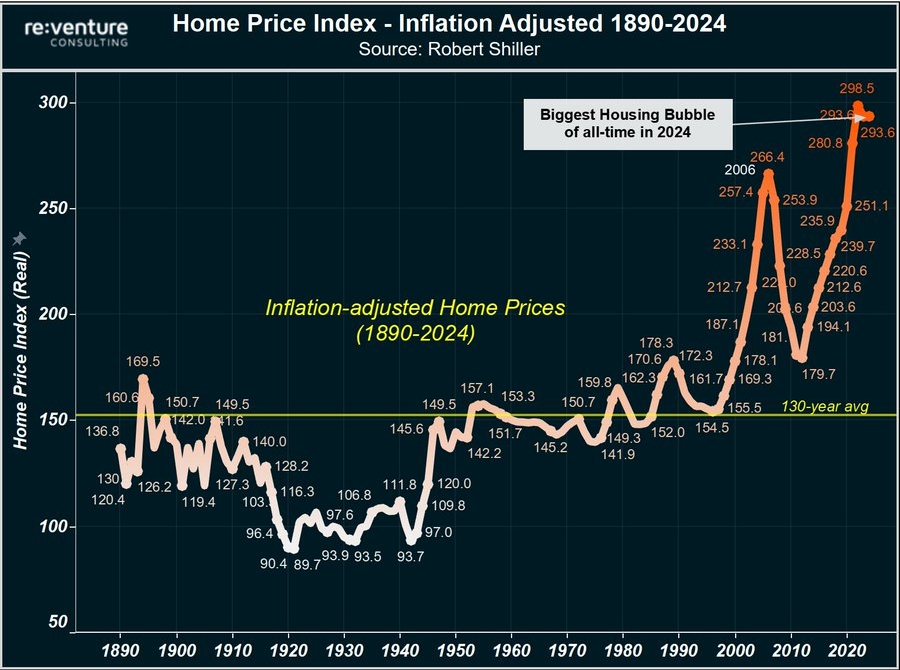

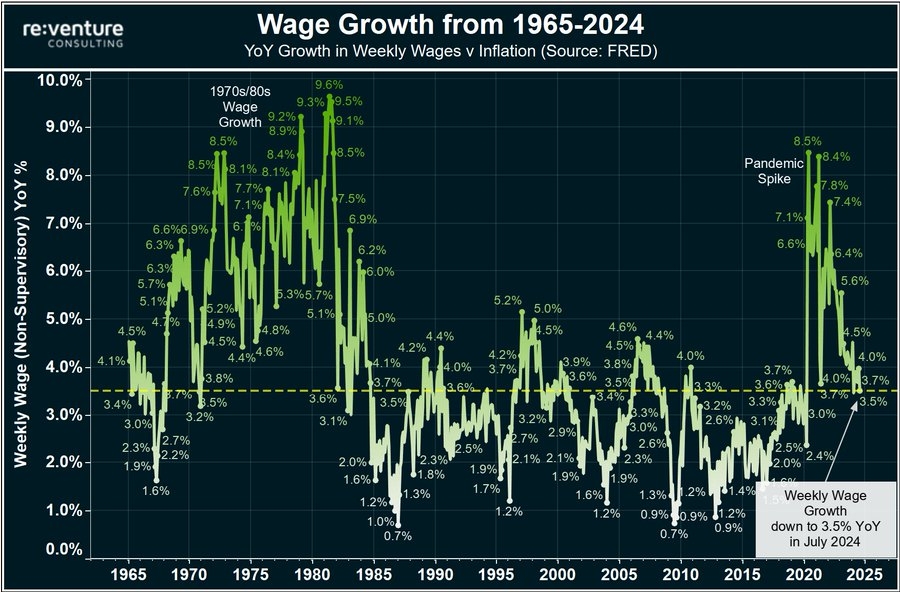

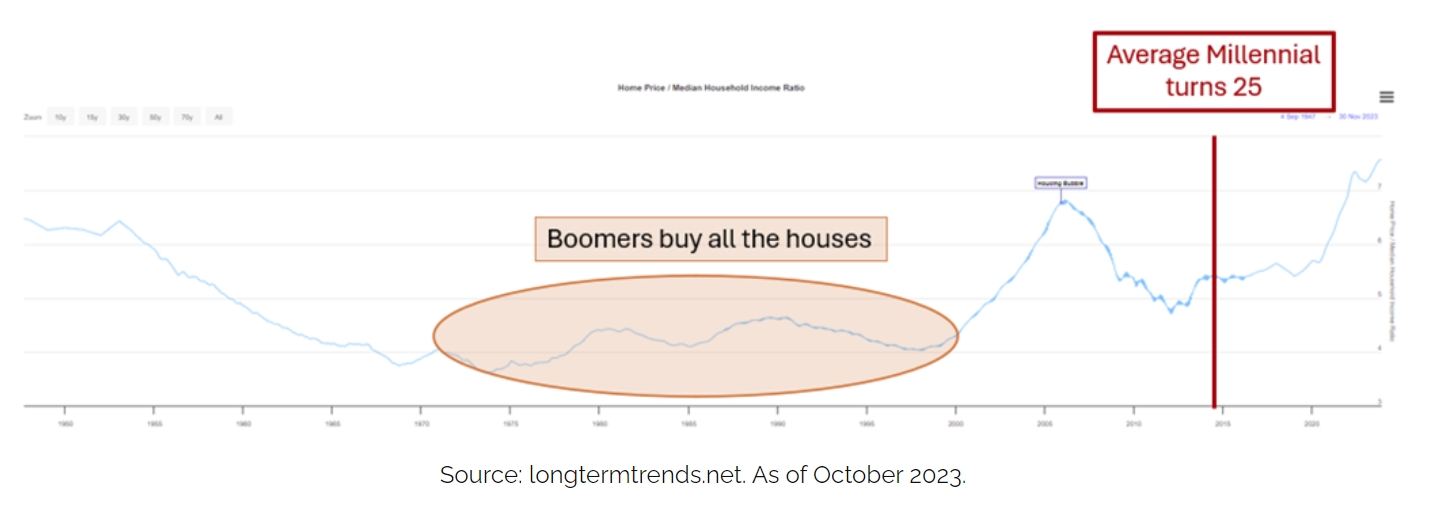

This window of subjectiveness is shifting among the most online people, who typically skew young, and spend more time on social media whose algorithms push unattainable beauty and lifestyle standards, all while more money is printed devaluing each paycheck you make and is amplified by the supply of a staple in the lower rung of Maslow’s needs stagnating - namely, housing.

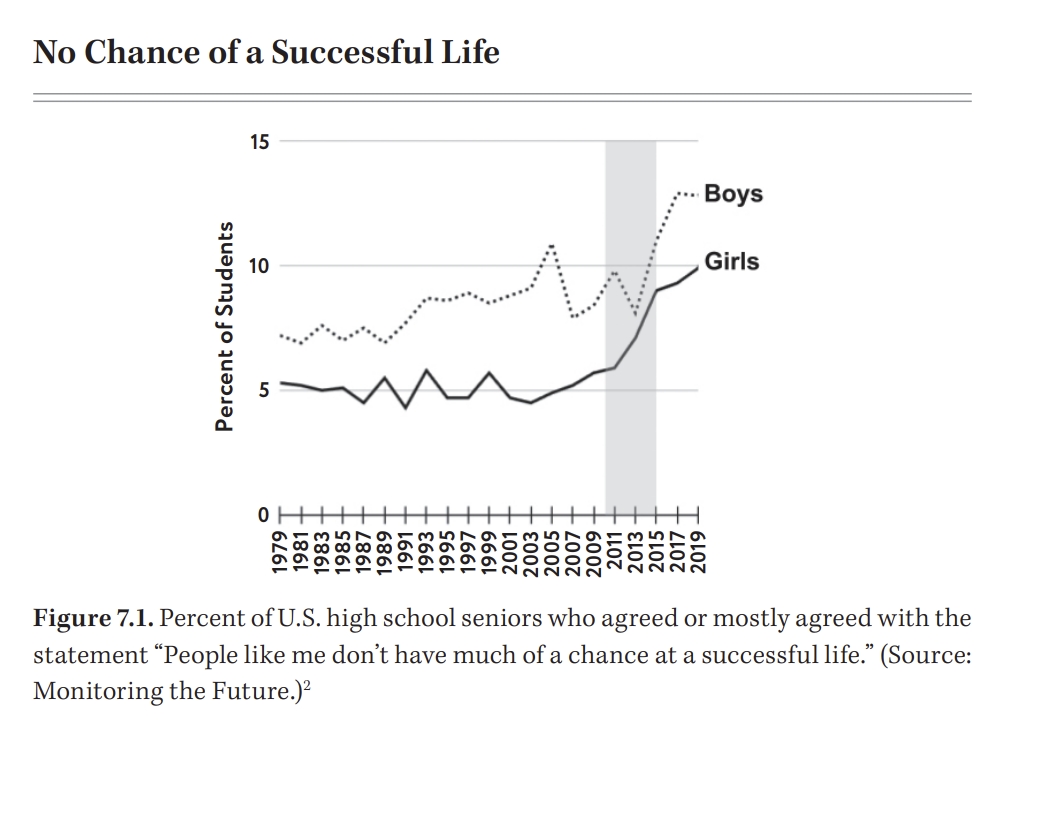

In his recent book “The Anxious Generation,” Jonathan Haidt cites the charts below suggesting that younger folks feel less satisfied with themselves and think they have no chance of a successful life. Given the subject of the book “the psychological damage of a phone-based life,” it’s possible this subjective window could be shifting due to the unrealistic lives young people see on social media.

$1,000 to $100,000: Wagecucked

You go to your job, work a hard day’s worth of work, get your paycheck, budget reasonably, and save about $200 bucks a month. Over 2 years you save $4800 but things cost 3-5% more and your purchasing power goes down. Maybe you’re savvy enough to put that $200 a month into the S&P and get some multiple on that, but you need your house now, you want to start a family now, and you’re tired of working for someone else, you just want to start your “real life.”

Don Don DOOON! You’ve been wagecucked.

With the cost of homeownership soaring, the gap between what young people have and what they need feels insurmountable. The only way to bridge this gap, in their minds, is to risk it today, not slow and steady savings. Study the sigma grind set and the need to lock in.

Folks see having $1,000 and having $10,000 as essentially the same. Neither amount brings them significantly closer to major financial milestones, like buying a home. They are in the same tier of lifestyle, so they gamble hoping to leapfrog into a higher lifestyle tier.

Because the gap between $0 and $10,000 feels minimal, the risk of losing $10,000 doesn’t seem like much of a loss. It feels like betting $0 because that amount isn’t seen as enough to change their situation significantly. The potential to turn $10,000 into $1,000,000 feels like the only way to make a real difference in achieving the American Dream. The thought process is: “If I can make it to $10,000, why not risk it all? If I lose, I’m not meaningfully worse off, but if I win, I could actually buy a home.”

The trade was supposed to be; I will be a wagecuck in exchange for a guaranteed roof over my head and some confidence that next week when I go to buy milk the price will be close to what it was the week before. But that trade is trending toward dead. There has been a noticeable vibe shift away from confidence in what will be there tomorrow and as a result more and more young people are taking risks to get ahead today. Either I get way ahead or hope UBI comes and saves me. Maybe if I’m lucky a loved one will pass away and they’ll leave me something… WTF DID THEY DO TO US!

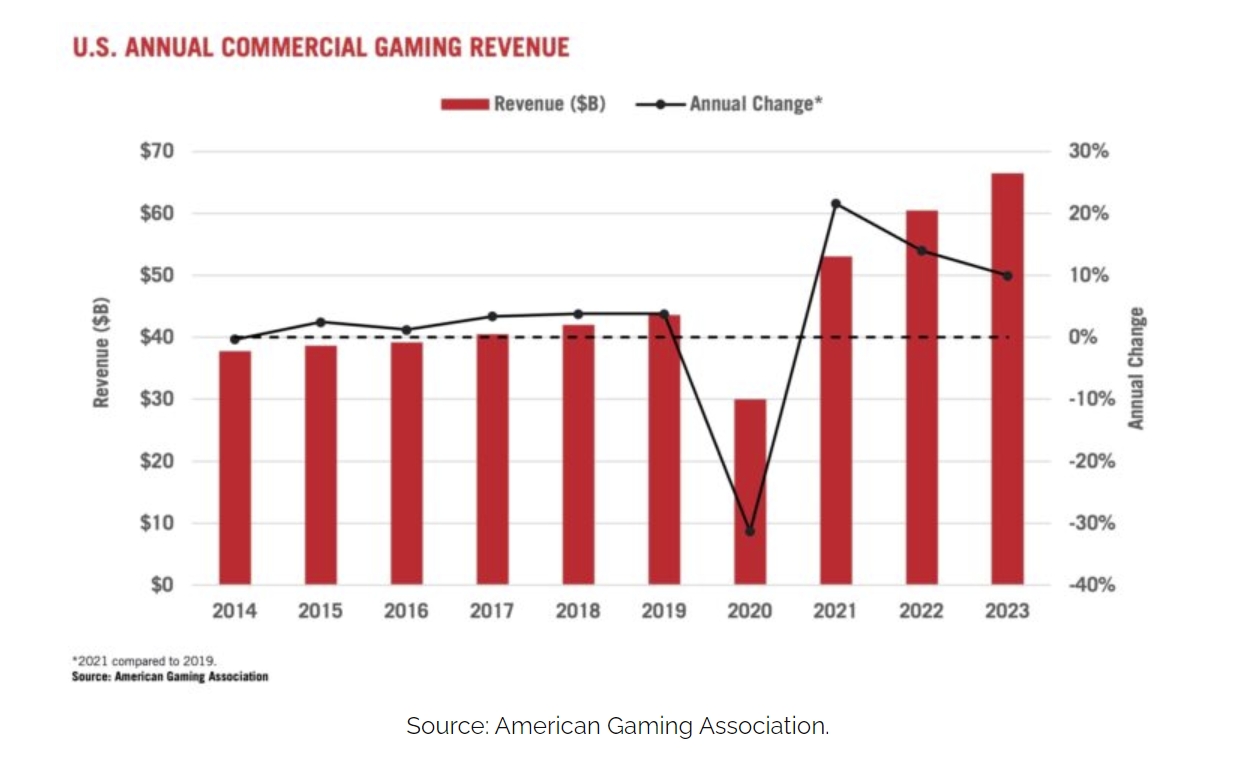

Travis Kling includes the charts below that showcase this trend and an uptick in online gambling, sports betting in particular, and the median cost of a house in his must-read piece on the subject, “Financial Nihilism.”

$100,000 to $999,999: Six-Figure Hell

A privileged position to be in and hard to exactly have sympathy for this group, but the emergence of the term/meme is a bit telling of where people’s heads are at when it comes to what it means to have financial freedom.

Kel highlights the absurdity of disappointment in having only six-figures among those on crypto Twitter in particular dubbing it “financial dysmorphia.”

$1,000,000: Life-Changing Money

$1,000,000 is a tier of wealth that feels like you have some escape velocity.

It’s the kind of money that can change your life, let you buy your first home, feel financially secure, or chase a dream. The difference between $10,000 and $1,000,000 feels enormous compared to the relatively minor difference between $1,000 and $10,000, or even $100,000.

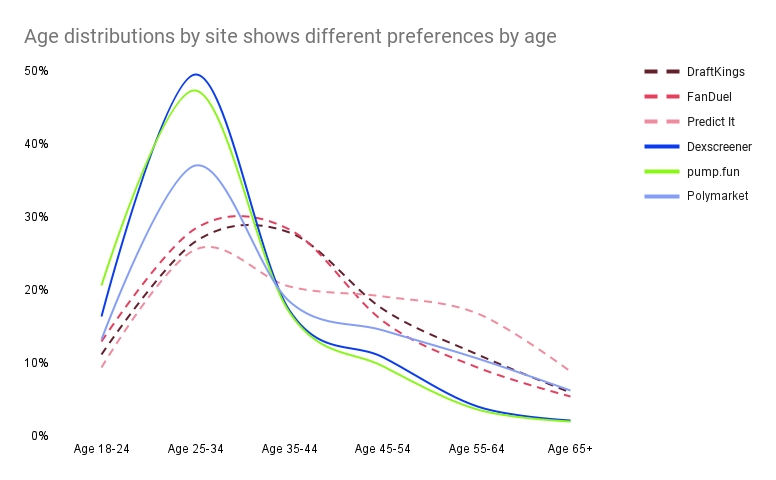

Crypto & Betting Web Traffic Demographics

Data from web traffic and betting volumes on popular gambling and speculation sites show that young people are ramping up gambling at a staggering pace. Among them, the youngest users are more likely to use memecoin and other crypto products whereas older millennials and older generations stay within more traditional betting platforms.

Web Traffic & Demographics of Different Types of Online Speculation Apps

Sportsbooks and daily fantasy/skill-based games are good because they are simple, lindy, regulated, entertaining, and to some extent social. However, sportsbooks fall short when offering the best lines (the default moneyline bet being -110 on most major sportsbooks) and limited market selection - the bettor is limited to the lines the book wants to open for wagering. It is also notable that online sports betting platforms will limit your bets to basically nothing if you outperform consistently. Establish the Run’s Jack Miller describes why sportsbooks limit and what a world without limiting would look like in the quote below.

"In a sentence: Sportsbooks limit because they can and it’s optimal for them to do so from a business perspective…It’s helpful to consider the other extreme – a world with no limits… A world without limits also means the competition increases. There are people out there who beat NFL sides on the weekend. People are betting highly popular games at post because it lets them get the most money down. More importantly, there are companies with very smart people who don’t invest much or any money in sports trading simply because the payoff isn’t worth their time. Take away limits, and suddenly it is worth it for them. In other words, people who are either exclusively focusing on the most liquid sports markets or not betting on sports at all would suddenly become interested in markets that are currently relatively beatable."

Because of these shortcomings, bettors migrate to other markets, such as prediction markets and the memecoin casino.

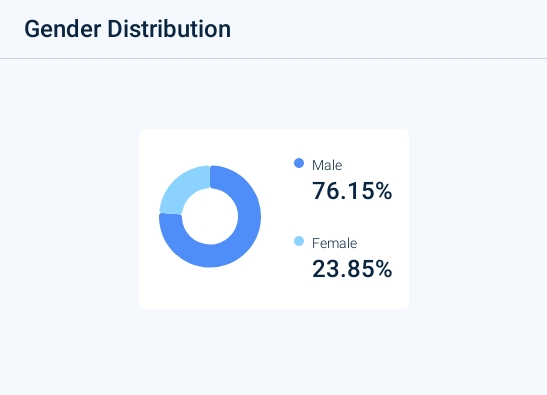

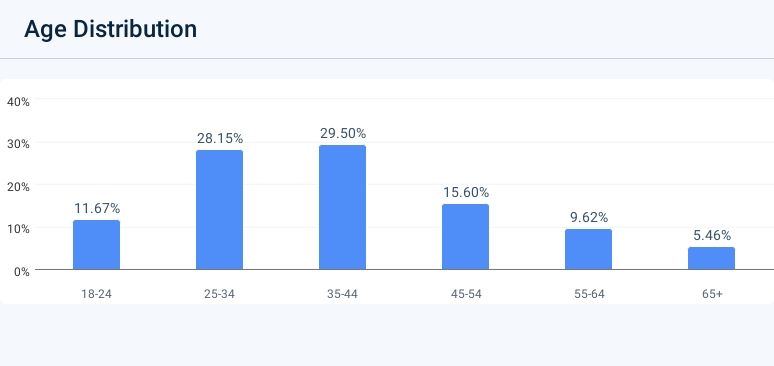

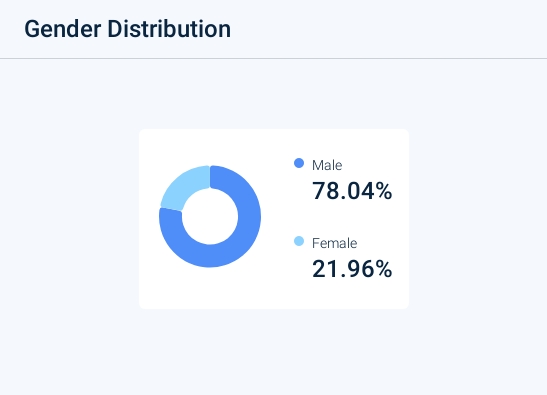

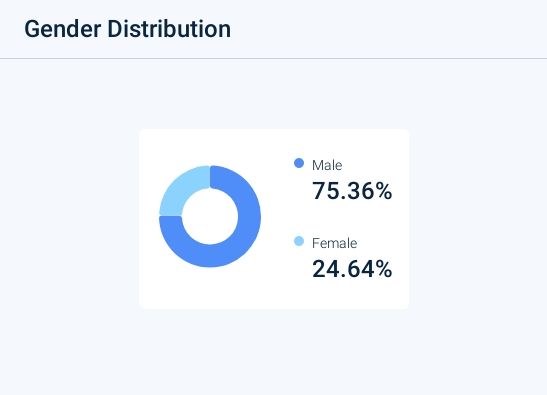

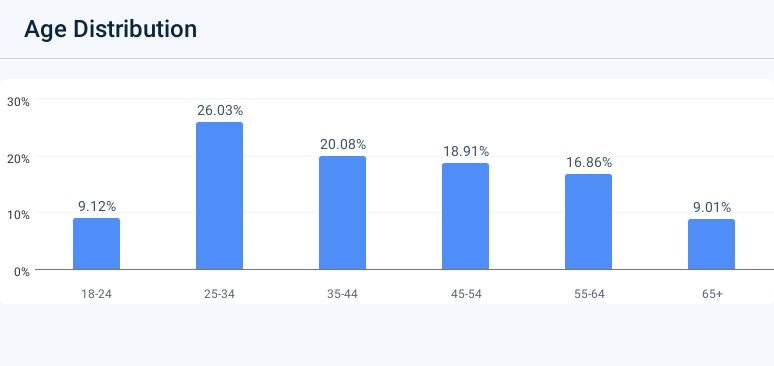

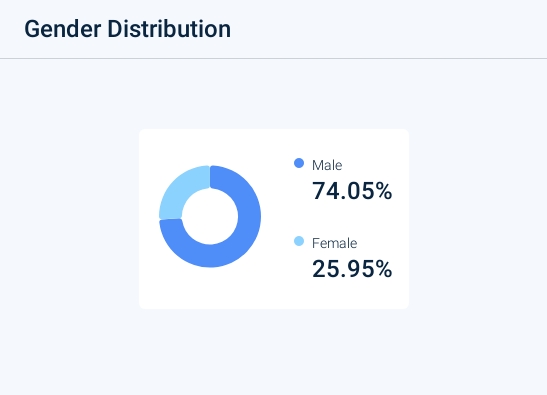

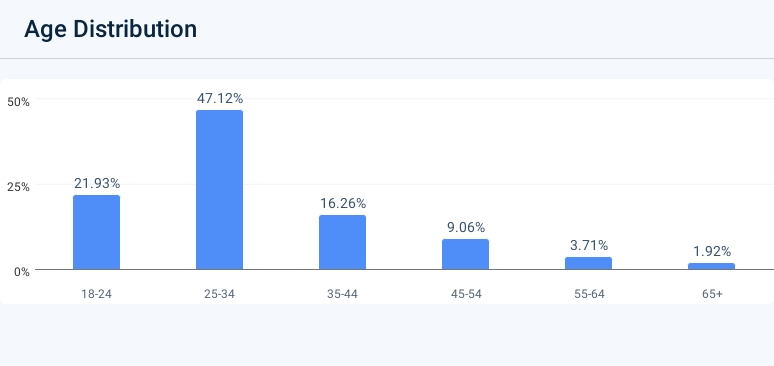

Based on web traffic data from Similarweb the bettors on US sportsbooks and daily fantasy/skill-based games are overwhelmingly Male (76%) and between the ages of 25 & 44 years old (54%).

DraftKings

FanDuel

Polymarket, a prediction market, ****often provides an edge over traditional sportsbooks when it comes to the "line" you take. Unlike sportsbooks that profit from lost bets, Polymarket makes money from the volume of trades. This allows for default bets to be closer to +100 or even. Additionally, Polymarket offers the option for instant cashouts by selling your shares, which can often yield better returns than the "cash out" options offered by traditional sportsbooks, where the payout is typically well below the line you could get on Polymarket.

If you want to bet that Patrick Mahomes will be this year’s NFL MVP, you typically have to lock up your cash for a long time - something most bettors are reluctant to do. Instead, you might consider buying shares of Mahomes as the MVP on Polymarket, allowing you the flexibility to sell those shares later if you choose to at a fair market price.

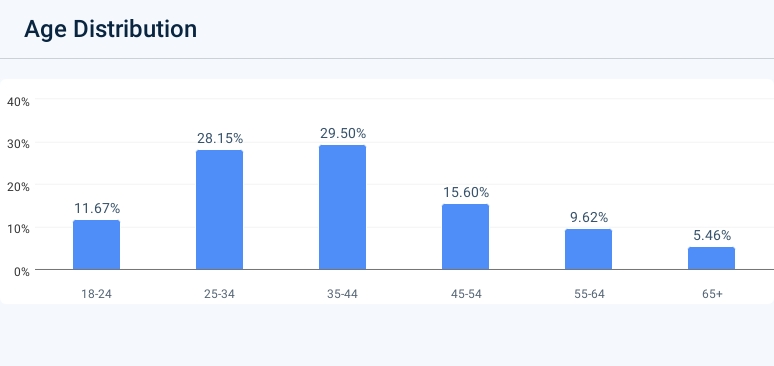

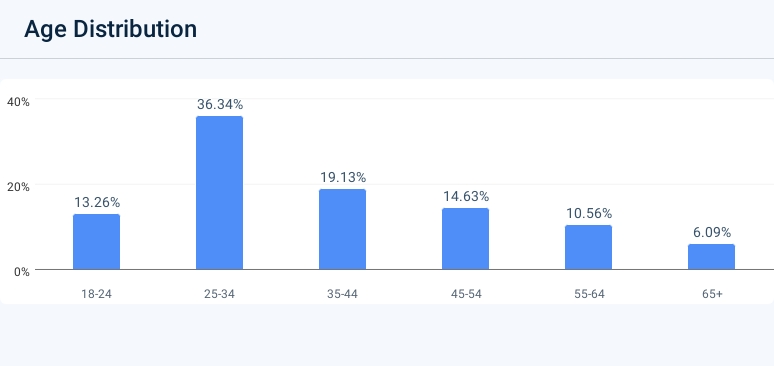

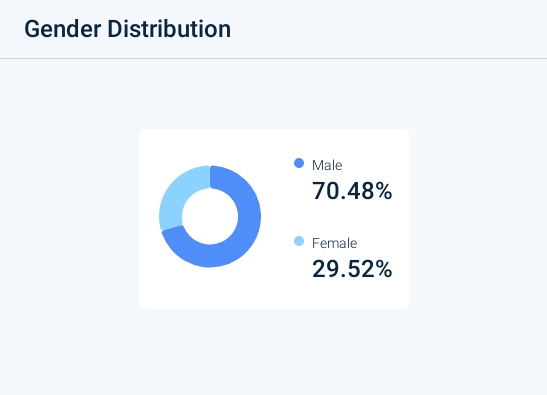

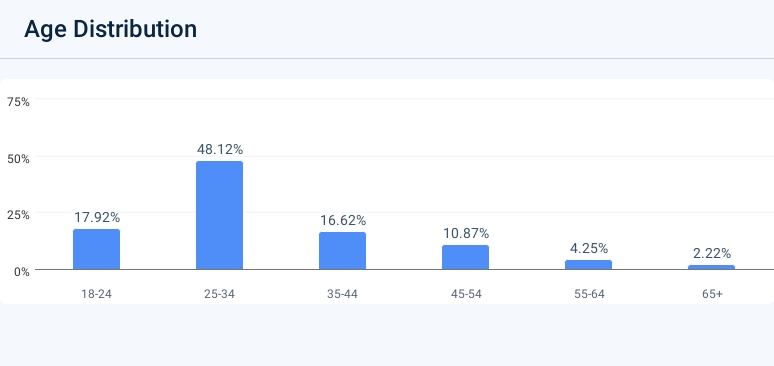

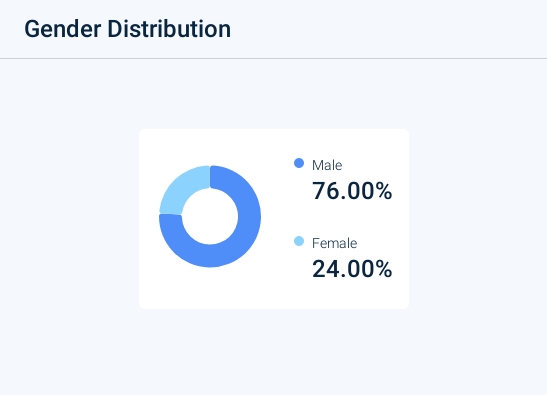

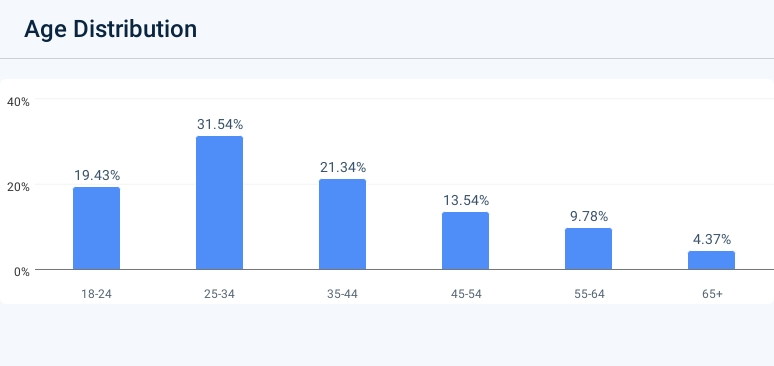

Gender & age distribution of users of Polymarket and Predict It (another popular prediction market without crypto features) are predominantly male, 75% on Polymarket and 70% on Predict It and while both see more traffic from those on the younger end of the distribution curve, it’s notable that Polymarket, a product with crypto features, skews way younger.

Nearly 50% of Polymarket’s web traffic comes from those between the ages of 18 and 34, whereas about 35% (15% less) of the traffic from Predict It (the non-crypto integrated product) fall in the same age range.

One area where Polymarket and Sportsbooks fall short is uncapped upside. This is one reason folks move further down the speculation ladder toward memecoin trading.

Polymarket (Crypto-Enabled Product)

Predict It (web2/non-crypto product)

pump.fun and the memecoin casino is the latest continuation of speculation on crypto rails from OG altcoins/ICOs/yield farming/ to NFTs… this arena attracts those who want to hit big, and while on surface level a 5 leg anytime touchdown parlay will pay out massively - winnings are taxed similarly to any profits you would make in memecoin trading, but memecoin losses are tax deductible. Another advantage memecoins have over sports betting or traditional prediction markets is their virality effect, memecoins are nihilistic and when people make money off of something stupid it makes those who didn’t mad, that’s part of the fun and why they’re so talked about and one reason why the more online generations are leaning into them as a way to gamble.

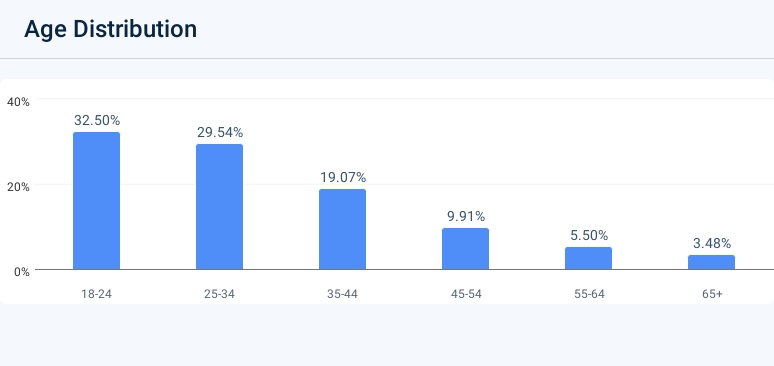

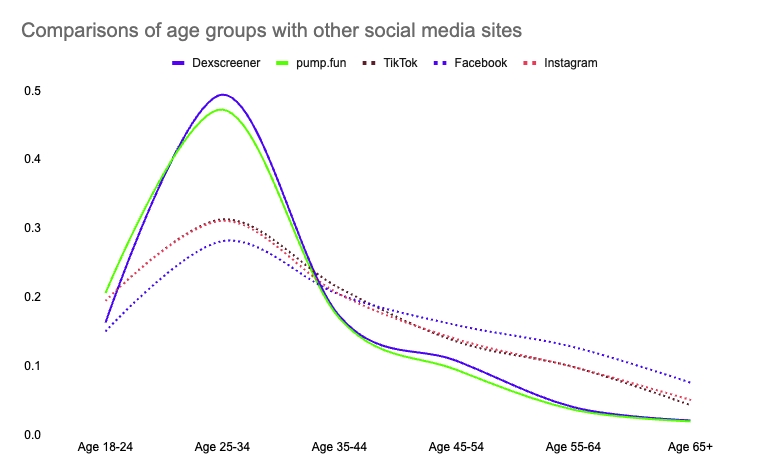

The people visiting pump.fun, and to add a data point, we also pulled web traffic for Dex Screener are again, overwhelmingly male, 76% for Pump and 74% for Dex Screener. Age-wise 66% of Dex Screener’s traffic comes from 18 -34-year-olds and 69% of pump.fun’s traffic comes from the same age range. A 19% jump from Polymarket traffic among 18-34 year-olds.

This crowd is younger, more tech-savvy, more willing to embrace risk, and less biased against crypto than traditional bettors.

Dexscreener

pump.fun

Reference Points / Control Group

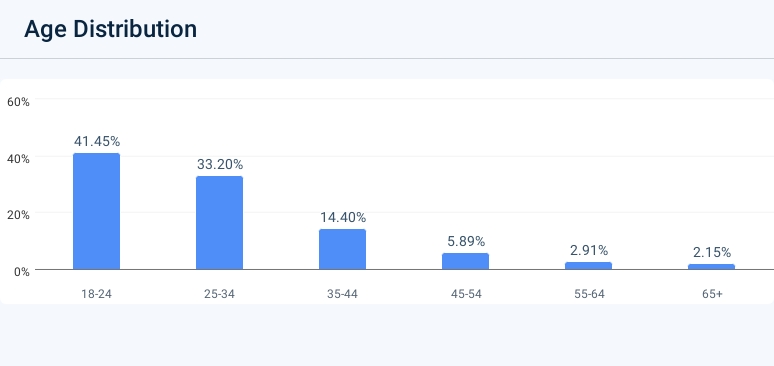

To put some of this data into context, we pulled age data from apps known for having younger users, and pump.fun and Dex Screener fall within a similar age range as TikTok, Snapchat, and Twitch - the closest comp being TikTok.

TikTok

Snapchat

Twitch

Takeaways

- In the US more people are betting and people are betting more.

- Financial nihilism and financial dysmorphia are rising trends among young people who spend more and more time online consuming unrealistic lifestyles and are made to feel subjectively poor in comparison to social media’s warped projection of financial normalcy.

- It’s not just social media that causes this feeling of being subjectively poor, it is also the sentiment around not being able to secure a roof over your head and buy a home - the supply of which has remained stagnant for some time in the US. It’s not just nihilism for the sake of nihilism, it is a response to very real supply and demand of basic human needs.

- Boomers and Millennials favor sportsbooks and daily fantasy sports / skill-based games. At the same time, Gen Z ranks higher among crypto-enabled speculative products like trading memecoins and prediction markets with crypto onramps (Polymarket).

- What did they do to us?!

Further Reading

- Why We Have a Housing Crisis by Kyla Scanlon

- Financial Nihilism by Travis Kling

- Why play a losing game? Study uncovers why low-income people buy lottery tickets by Carnegie Mellon University

- The Casino on Mars by Matt Huang

- On the Edge: The Art of Risking Everything by Nate Silver

- A Discussion About Limits in Sports Betting by ETR’s Jack Miller

- For more on the evolution of online betting watch our recent podcast with the co-founder of FanDuel, Nigel Eccles.

Website traffic data sourced from similarweb.com

Written with help from @Drmelseidy, @xyczzcyx, @CarterMcAIister, @qwqiao and the @alliancedao team.

More to Read

Fintech RFS

Qiao Wang

·Dec 15, 2025

While it may seem that the low hanging fruit from the digitization of finance has been picked, about half of the world population is still either physical-first or outright unbanked. Furthermore, current technology waves – namely crypto and AI – have the potential to unlock greater value for consumers and businesses.

You're Vibe Coding Wrong

Mohamed Elseidy

·Jul 10, 2025

Most developers use Tier 1 for UX & rapid prototyping, Tier 2 for daily development, and Tier 3 for complex engineering challenges. The best strategy is to combine them when needed rather than trying to force one tool to do everything. Here's what each tier actually delivers and when you should use them

Your Moat Isn't Your AI Prompt. It's Your Evaluations

Mohamed Elseidy

·Jun 17, 2025

Anyone can copy a prompt, but they can't replicate the months of iterative learning, the domain knowledge and the edge cases discovered through real user interactions, and the systematic evaluation framework that guided every prompt tweaking decision.