How to get exposure to US real estate

David Ma

·May 7, 2024

Thanks Elliott, DC, and Villcaso founders Val and Nate for feedback on this post.

Background

Some people may know me through an interview I did four years ago with my more famous and charismatic brother Joma.

That interview mostly focused on machine learning and its interactions with product design.

But there’s another experience from that time of my life that I’ve told people in private but never took the time to write down. It was the vision that Elliott caught my attention with, but which we ultimately pivoted away from.

The question was why can’t we trade homes fractionally like we trade stocks?

Owning a home is fundamental to the American Dream. But just acquiring a mortgage to buy a home has become increasingly difficult. And once you do, this idiosyncratic asset now outweighs everything else on your personal balance sheet (for most people). Home insurance alleviates this risk, but you’re still exposed to what color your neighbor paints his house, whether Whole Foods is opening near you, the quality of your city planning, schools, traffic planning, etc.

It’s not surprising a number of startups start with this question and then navigate the idea maze only to find dead ends.

More recently in crypto/web3, the success of stablecoins and tokenized t-bills reignited the interest in real world assets (RWAs). As a result, startups working on web3 real estate are running into the same problems as web2 real estate. Despite the excitement, there are problems crypto isn’t meant to solve.

In this post I go through the problems in fractionalizing homes, irrespective of crypto. I talk about how and why most solutions end up converging into REITs (real estate investment trusts), a 50 year old solution. And finally, I describe why I’m excited at the prospect of Villcaso using HEAs to enable real estate investing in a way that is liquid, diversified, and low-maintenance. As was briefly illustrated in an earlier post about RWAs, Villcaso opens up a new asset class for crypto-natives to diversify into, which in turn will solidify the infrastructure that lets crypto-agnostics access US real estate.

The liquidity problem with home fractionalization

The immediate problem that I pointed out in 2017 was that liquidity would be non-existent if single family homes were fractionalized.

Fundamentally, the size of each individual asset is tiny (6 to low 7 digits USD) which makes low-friction market making nearly impossible. A market maker would need exceptional models handling real-time and high-dimensional data to correctly price an arbitrary home. A real case: the startup Opendoor tried to buy and sell homes sight-unseen at first. The result was wide spreads and still getting adversely selected. They barely made money on their flips in a bull market. Around the same time, Zillow Offers operated a similar business model to leverage Zestimate, their sight-unseen home price model. But the plan was scrapped for the same reasons.

NY Times, Nov 2021

Small assets structurally favor the small investor because the small investor can make a a good percentage return on their net worth by doing deep diligence on the asset. A large investor has to look for more scalable opportunities.

In the case of real estate, the deep diligence requires feet on the ground, physically. This is why all good real estate investors are geographically concentrated, and reach diseconomies of scale pretty quickly. All the largest residential owner-operators in the US top out around 10 to 30B market cap despite US real estate being the largest asset class in the world.

Even if we waved a wand and got to a world where homes were traded fractionally, the shares of a particular home would still only be owned by a handful of investors. Nobody would be putting up standing limit orders for fear of adverse selection. Trading would still happen between them over coffee and a handshake deal.

The governance problem with home fractionalization

Reconstitution is a problem with fractional assets. How can an asset be taken off the market? Usually, with a vote that passes 50% or some other threshold. The majority voters have the ability to engineer a deal that is beneficial to them but detrimental to the minority. For example, you can imagine a 51% owner deciding to sell the house at below market price to themselves or somebody close (see “at arm’s length”).

One solution is to give the minority owners a right of first-refusal. That means the minority owner would be able to match the buyer’s price to buy the property out. Although this alleviates the 51% attack, the minority has to be able to come up with the cash on short notice. Also, a right of first-refusal may deter legitimate buyers from having to deal with this operational mess in the first place. Why spend all the effort negotiating when you know somebody else can claim the rewards?

To see an example of fractional ownership reconstitution, we can look at public companies. Investment banks are hired as neutral parties to broker the deal. In the case of a home, you would basically be hiring an auditor to make sure there was no foul play in the sale process: that the home was presented clean and staged, that the listing was made on a majority of platforms to reach potential buyers, that the time on market and offer price is comparable to other transactions, etc. But again, the scale of an individual home would make hiring an auditor an extremely costly process. And while we are talking costs, think about entity registration fees, per-state, legal and accounting fees, all on a per-home basis. The economics already don’t make sense.

Then, there are operational questions. An investor who owns a fractional home for diversification is not incentivized to spend effort making sure the asset’s value is being maximized.

In the case of land, simply holding it might be ok because land needs very little maintenance. On the other side of the spectrum, high cap-rate multi-family apartments in undesirable neighborhoods depend on high quality operations to be profitable. Most Americans actually live in single-family homes where about half of the ROI comes from price appreciation, and half comes from operating the asset.

Most of the time, the land cannot be separated from the home. Therefore upkeep, renting (or living in) the home, and making home improvements are all crucial activities that add up to the investment returns of real estate.

Hiring a property manager is a solution, but somebody still has to manage the property manager, and now, the investor has to evaluate the management on top of the property itself. More on that in the REITs section.

The case for fractional homes

I would concede that having a way to trade individual homes could be fun. Imagine window-shopping, dreaming, and buying shares of an aspirational home. Some homes would become iconic for their unique style or location. Famous architect homes would become tradable art. A tiny percentage of homes would become memes.

But 99.99…% of homes would not enjoy any of this status.

All roads lead to REITs

So far we just assumed that trading individual homes would be something that investors wanted. But is that even the case?

The two problems we started with were:

- High cost of entry. The average person needs to save for years before having enough for a downpayment.

- Idiosyncratic risk. It’s hard for an individual to buy and manage enough homes in different geographies to average out idiosyncratic risk.

Most people do not have the bandwidth to select individual homes, do due diligence, and construct a portfolio that represents their thesis. They would just benefit from a cheap and simple way to get market exposure to real estate at the country or city level.

All the problems I mentioned earlier involving liquidity, governance, and investor needs, all point to REITs, a structure that has existed for decades.

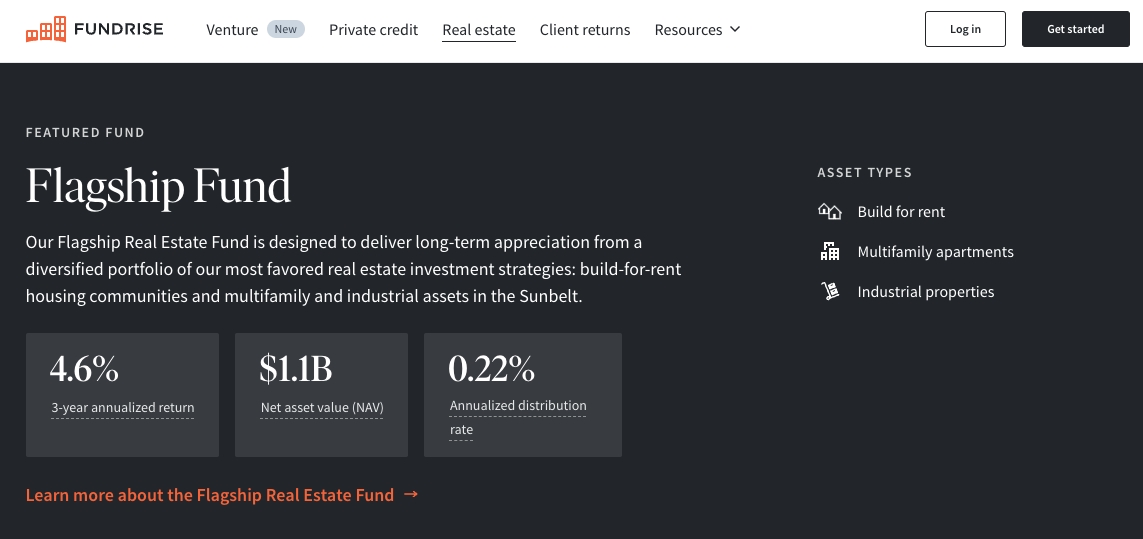

Even Fundrise, a semi-recent startup that tried to democratize real estate deals, converged into a basically private REIT.

Old Fundrise emails from 2015, allowing investment into individual projects

Fundrise today is basically a REIT now

However, there are problems with REITs too:

- A large part of what you’re buying is the management company, their operational excellence, their asset choices, and the financial engineering that they decide to apply to their business.

- REITs are geographically constrained in order to achieve operational efficiencies.

- Public residential REITs almost all manage multi-family buildings, which skews the investment quality even more towards operations as opposed to land value.

On the first point, REIT management companies have the incentive to bet on themselves. Management is paid in accordance to their outperformance to the market. Therefore there are always incentives to take leverage on things they can control like operations, asset selection, and market timing. That is to the detriment to the investor who is only looking for passive returns.

On the third point, it’s informative to think about real estate assets by decomposing it. Real estate returns can be split into price appreciation, and operational returns. The asset itself is a building sitting on top of land. The building usually does not appreciate. You can make home improvements and the market may reward you for the work, but an unimproved home does not appreciate. The rare case is when it was designed by a famous architect, or when raw material price surge. Land value is the thing that one wants to invest passively in.

It would be great if there existed a VTI/SPY of US residential real estate land. I bet it would make a great passive investment vehicle.

Enter Equity Mortgages (or Home Equity Investment Agreements)

What if it was possible to issue a mortgage that didn’t collect debt but equity? If it was possible to buy a small enough percentage of a home so that the main owner would not behave substantially different. We would be able to share in the ups and downs until the home was sold. If we packaged enough of these equity mortgages, it would become a liquid, fractionalizable, and operationally lightweight asset that reflected US residential real estate.

We debated this idea at lengths in 2017. How do you collect rent? How do you incentivize home improvements and who pays? How does the lender get liquidity when the borrower is incentivized to sit forever on the home?

Ultimately, we decided that it was not something we wanted to pursue as a startup. Equity mortgages effectively did not exist in 2017.

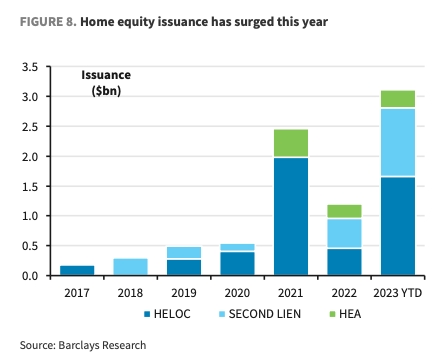

That was true until recently. Starting in 2021, we’ve started to see a form of equity mortgages come into fashion. The industry term is still in flux, but these all refer to the same concept: Home Equity Investments, Home Equity Investment Agreement, Equity Sharing Agreement, etc.

The anatomy of an HEA is surprisingly simple:

- The borrower receives up to ~20% of the property value up front, paid by the lender

- The lender receives home equity at a discount, typically ~2x what the borrower received. E.g. a 20% payment would get 40% of the equity.

- However, the lender does not receive any rent payments and the borrower gets full rights of use of the property.

- The contract matures in 10–30 years, where the home must be appraised and the equity be bought back. Other liquidity events would also trigger the equity buy back.

I won’t list out the additional modifiers and parameterization of HEAs. Interested readers can find them in the related links section.

Different origination companies (Unison, Unlock, Point, and others) have come up with slightly different variations on the contract, but they all share these most important consequences:

- A dollar invested creates ~2 dollars of exposure to the price of the home.

- The asset does not need to be operated. The main home owner takes full benefit and responsibilities. This is in contrast to REITs where your investment has exposure to the management company.

- The asset is not sensitive to the borrower’s credit worthiness, but rather the value of the real estate.

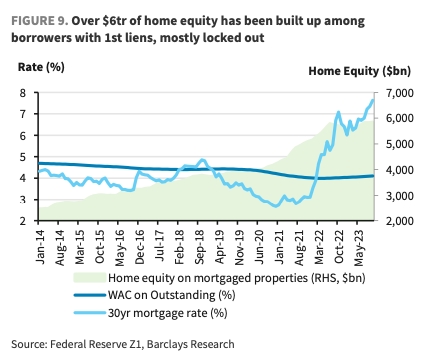

Today, these instruments are still very new. The contract details are still annealing to find the right balance between all parties involved. It’s possible that high interest rates are making new home buyers search for alternative solutions to debt, contributing to the rise of HEAs. Or existing home owners who have built up equity but locked in a low-rate 30yr mortgage, wanting to take out some cash.

One thing is for sure, their recent growth is worth a consideration. Wall Street is starting to take notice. In October 2023, Morningstar rated an HEA securitization for the first time, opening up the gates for many investors who rely on their stamp of approval.

Villcaso

As was mentioned in an earlier Alliance post about RWAs at large, Alliance and myself are invested in Villcaso.

Villcaso was the first real estate tokenization team we found who gave me an impression that they could build an investable vehicle for a US real estate index. Their innovation is at the confluence of many things: to uncover the HEA opportunity, to have access to the investments, to find a legal way to tokenize these assets and have them trade on a secondary market without restriction.

If Villcaso is successful at their mission, we could see a new liquid asset class on par with US equities in size.

Why on-chain? First, to go international from day 1. Non-US residents must go through complex legal, tax, and brokerage options in order to access US real estate. There is no doubt that friction is preventing many from investing.

Second, off-chain-native asset classes have a lot of baggage that tie them to their existing infrastructure. However, the story is different for new asset classes. We’re starting to see new assets classes choose on-chain by default because of the permissionless composability that they can plug into from day 1.

Third, US real estate is investment-grade diversification for crypto-natives. Of course no asset class beats crypto in a bull market, but when the dust settles, there will be an extra option for us to diversify into.

https://medium.com/alliancedao/real-world-assets-real-world-adoption-11015282a69e

Appendix: Flooring Protocol

There is a fractionalization protocol in crypto that is semi-popular (so far) called Flooring Protocol. The idea is to treat most of the NFTs in a group as fungible. Depositing an NFT into the pool creates you 1 million shares, and 1 million shares allows you to randomly redeem an NFT from the pool.

This enables a group of non fungible, but homogeneously-valued assets to be fractionalized horizontally.

It’s unlikely that such a mechanism would be appealing for homes.

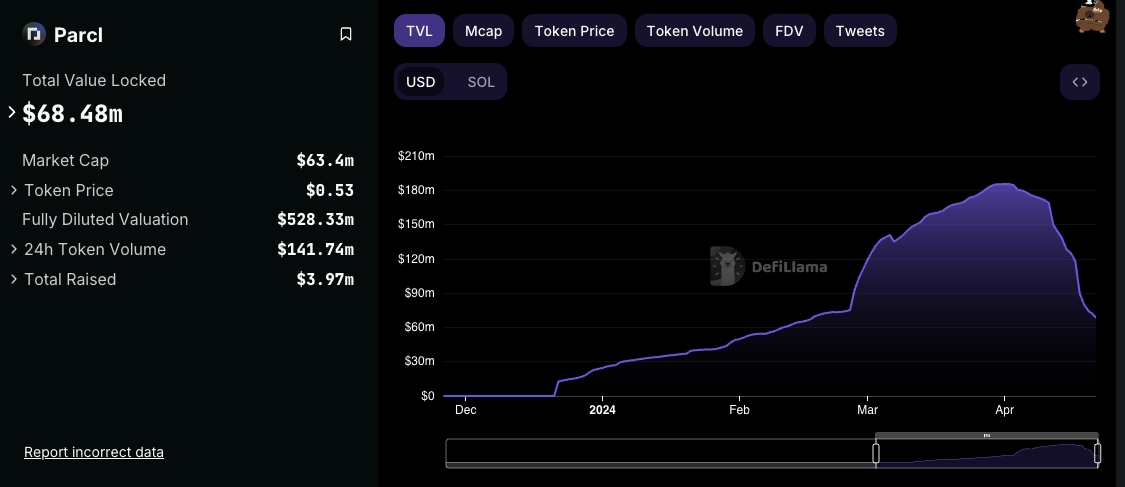

Appendix: Parcl

Parcl is a very new protocol that attempts to create the most up-to-date real estate index of a city. This allows for perpetual futures to be traded against the index.

Right now there is maker-liquidity and trading because of an expected token airdrop. If successful, I suspect takers to be long-term perma-long and makers to be perma-short. The makers will have to hedge by buying real homes in the instruments they are making. Parcl becomes more of an abstraction layer between investors and REIT-like owner-operator entities.

Update (2024–04–21): TVL has in fact dropped considerably after the airdrop. I suspect providing liquidity for a perps product will not be easy because hedging is very difficult. Purchasing homes outright is an operation. Finding other real-estate-linked instruments, is literally the subject of this blog. Villcaso, if successful, might end up helping Parcl market makers here by providing a correlated liquid instrument.

Appendix: Mortgage-backed securities

MBSs are a bunch of mortgages bundled up and sold as a whole, often tranched by risk or duration.

These instruments are operationally lightweight, and one could cover the US pretty easily. But in normal times, they are more of an interest rate product rather than a real estate product. That is, their value fluctuate more according to interest rates than home prices. Only during distressing bear markets like 2007–08 do their value correlate with home prices.

More to Read

Fintech RFS

Qiao Wang

·Dec 15, 2025

While it may seem that the low hanging fruit from the digitization of finance has been picked, about half of the world population is still either physical-first or outright unbanked. Furthermore, current technology waves – namely crypto and AI – have the potential to unlock greater value for consumers and businesses.

You're Vibe Coding Wrong

Mohamed Elseidy

·Jul 10, 2025

Most developers use Tier 1 for UX & rapid prototyping, Tier 2 for daily development, and Tier 3 for complex engineering challenges. The best strategy is to combine them when needed rather than trying to force one tool to do everything. Here's what each tier actually delivers and when you should use them

Your Moat Isn't Your AI Prompt. It's Your Evaluations

Mohamed Elseidy

·Jun 17, 2025

Anyone can copy a prompt, but they can't replicate the months of iterative learning, the domain knowledge and the edge cases discovered through real user interactions, and the systematic evaluation framework that guided every prompt tweaking decision.