Where Whales Went to Work in H2 2023

David Ma

·Jan 25, 2024

When I was in my 20s, I subscribed naively to the idea that free markets were the best form of markets. My opinions have mellowed now — perhaps that’s wisdom or simply, age.

I won’t make the pro case for free markets since it’s what characterized most of the last 50 years.

The against case… Free markets entangle every corner it reaches, allowing a global optimization to form. Patches of the world reorganize themselves to hyper-specialize. But it’s clear to me now that this optimization leaves local economies stuck, over-invested, and becoming dead zones when market winds change. The booming economy gets fully exploited in pursuit of the short term global optima.

There’s no shortage of example: mining towns boom and busts, Venezuela’s overinvestment in the oil industry which sealed their fate in mid-2010s as oil prices dropped. Even in the US, Detroit’s automobile and the Rust Belt’s manufacturing becoming no longer competitive in the global economy led to big lulls in the local economy.

And in the crypto world, Axie Infinity shifted a large swath of the Philippines to earn income driven by a global speculative craze. For the most part, this last example turned out for the best. The craze did not last long enough to product structural changes to the local economy.

But it doesn’t matter what I believe is the right amount of free market. I just interview founders. The fact is, crypto is currently the freest market in the history of markets.

Money flow in crypto is a market fundamentalist’s wet dream. It’s peak globalization of financial markets. Free flowing capital. Like water streaming to fill the smallest crevasses with the highest yields.

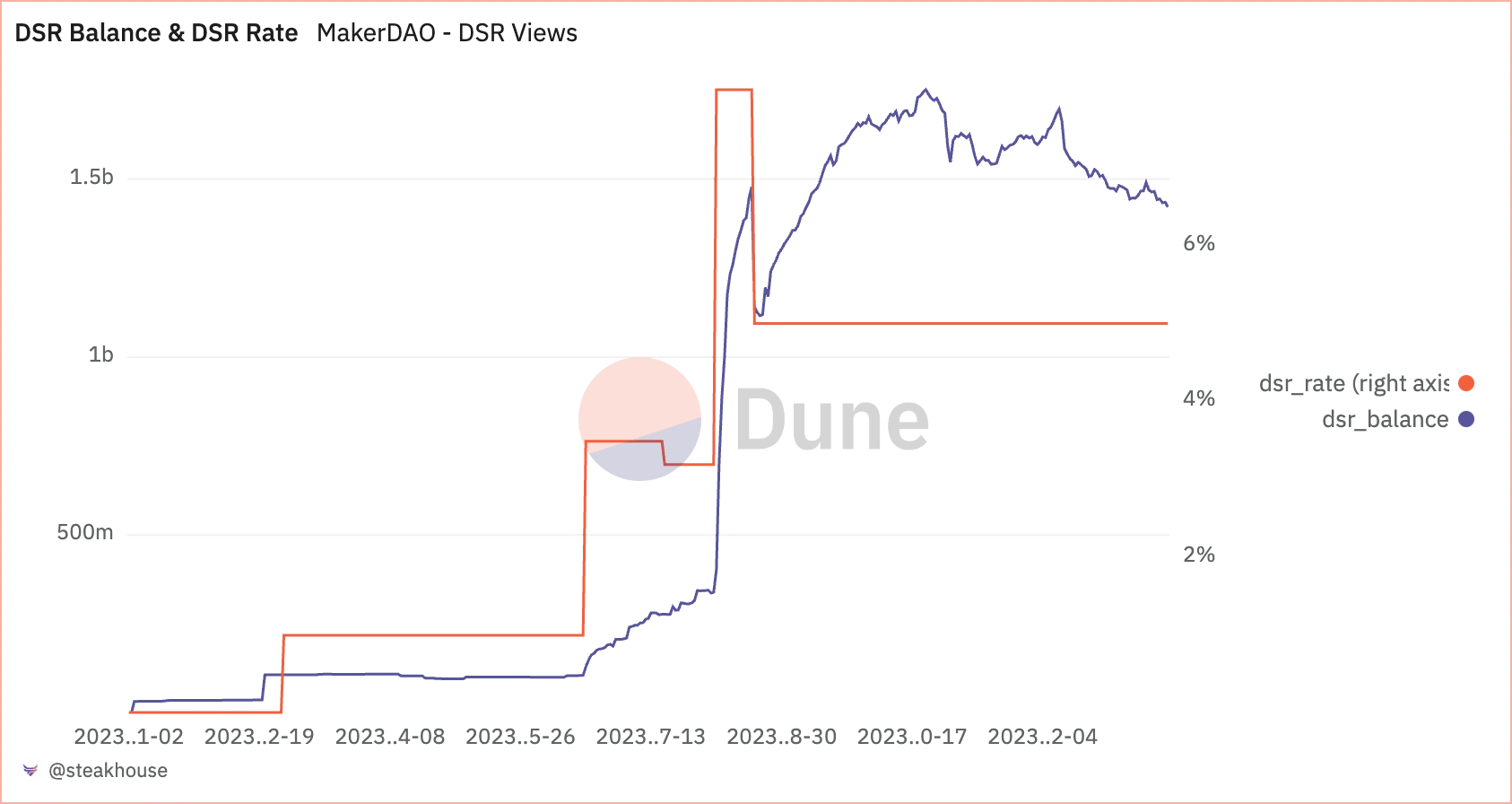

Treasury Bills vs Maker’s sDAI at 8%

In the depths of the bear market (not really deep), on-chain yields compressed below 5%, below short term treasury yields. Total stablecoin market cap slowly shrank as a result.

Maker had been putting the collateral backing DAI to earn off-chain yields — our industry decided to call this RWAs (real world assets). Maker had silently turned itself into the largest RWA provider in defi. It’s still unknown to me how this was enabled legally speaking.

My best guess is that sDAI does not have an actual claim on the yield that Maker generates. Maker is merely controlling the DAI borrow and lending rates to stabilize DAI’s peg to the US dollar. And on the other side, the collateral is being used to purchase treasury bills. It just so happens that the DAI saving rate of 5% is very close to treasury rates.

In fact, for two weeks or so, Maker decided to give sDAI a juicy 8% yield as a sort of promotion. Their TVL immediately shot up by 5x, a large part of it coming from His Excellency Justin Tron who never misses an opportunity to grab free money.

The promotion definitely worked because the capital continued flowing in even after rates normalized back to 5%. Maker quickly established itself as the most liquid place on-chain to park stablecoins. Liquidity is sticky. And all it took was $1mm in “advertisement”.

Meanwhile, newer T-Bill RWAs like Ondo Finance and Mountain Protocol are fighting for every million they add in TVL, despite their cleaner product structuring. More on them later.

Nipping at Lido’s feet

For a while in 2023, the narrative revolved around Lido’s dominance in liquid staking ethereum and how they should be self-limiting or not in the name of decentralization.

Early attempts at taking on Lido were mostly undifferentiated — point programs, defi integrations, influencer campaigns, and promises of implementing Distributed Validator Technology. The market did not respond to any of these. With no bull market in sight, and uncertain ROIs, point rewards were not valued. Participants were risk-off and satisfied with the status quo.

Diva (first to integrate DVT) and Swell both launched Enzyme pools around Q3 2023 to incentivize early commitment. Neither of the pools reached their publicly shared target outcomes. Today they sit at a combined ~25k ETH, a long way from Lido’s 9.3m ETH.

Enter Blast L2 native yield

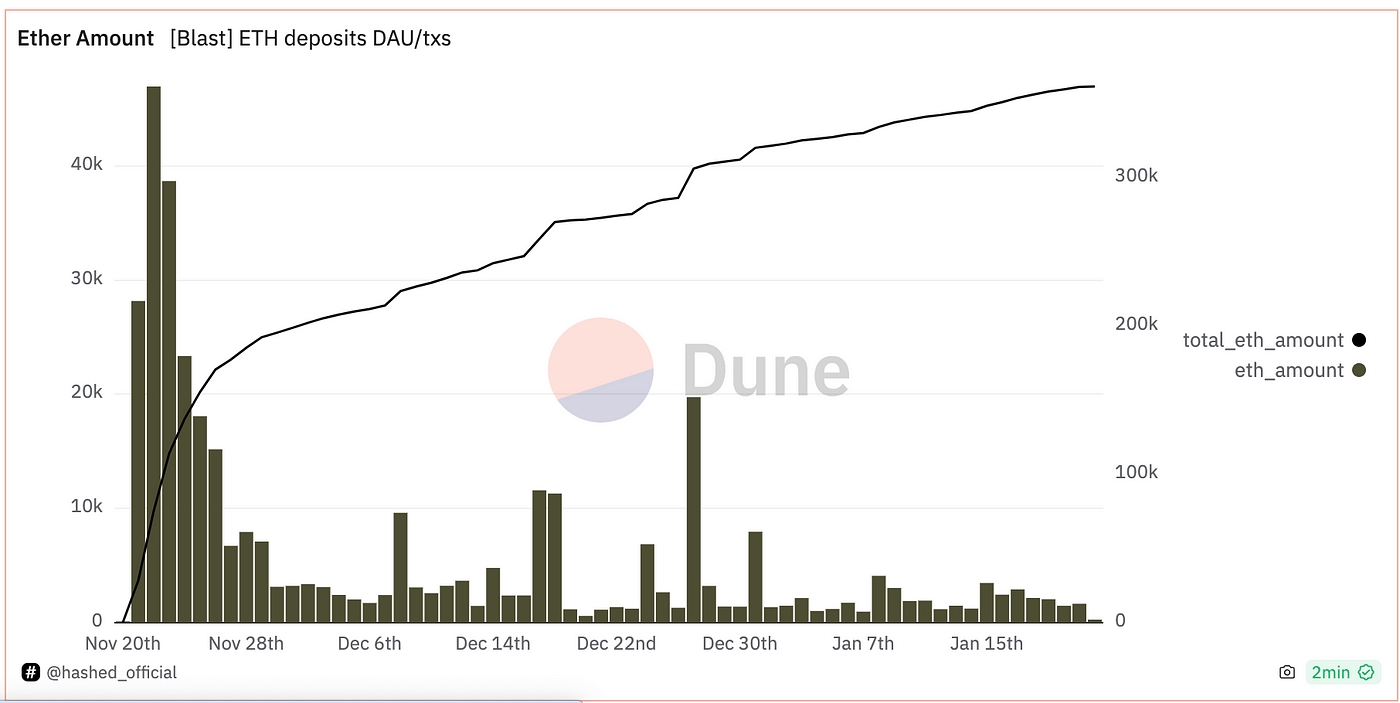

Coinciding with the end of Blur’s season 2 airdrop, PacmanBlur did not drop a beat and announced Blast’s L2 with native staking yield in Nov 2023. Immediately, a flood of CT influencers re-tweeted and announced their angel investments in Blast.

Despite having no product at all except effectively a multi-sig to take and stake the committed ETH, the marketing effort pulled in 185k ETH in a week and ballooned up to 360k today. Almost 5% of Lido’s TVL was locked until May 2024 expecting a lucrative airdrop.

Staked ETH had been mostly a L1 feature until recently. Popular L2s like Optimism and Arbitrum use native ETH as gas token, and they do not risk their users’ contract locked ETH in any form of staking. The only form of staked ETH on L2s is bridged wstETH, the non-rebasing version of Lido’s staked ETH. And even then, the liquidity is pretty insignificant.

So naturally, it was only a matter of time that the market got what it wanted. Yield and Capital Efficiency. Not scaling. Scaling is the narrative undercurrent, but yield is what mobilizes a market.

Of course this is half tongue-in-cheek. It’s unclear if there was one main reason Blast brought in so much TVL when other projects did not. Reasons I can think of include timing the early innings of a bull market, getting CT influencers on their cap table, the Paradigm name, having an established brand and project (Blur), or maybe the referral points game.

Copycats

After every successful event, there are bound to be copycats in crypto. The key is in moving really quickly, and one-up the original in some ways. Mantle L2 and Manta L2 (very confusing names) quickly popped up in less than a month after Blast and announced their own L2 native yield program.

Mantle decided to pay ~7% on depositors’ ETH, exactly double the staking yield. The extra yield comes from their massive treasury looking for product market fit, raised at the top of the bull market in 2021. It also help that their staked ETH ticker, $mETH, is a natural fit for memes.

Manta on the other hand hacked together a defi ecosystem in record time, and copies Blast’s referral point game, even the NFT cards and boxes.

This led to a combined ETH stake of over 450k ETH, without counting other assets bridged.

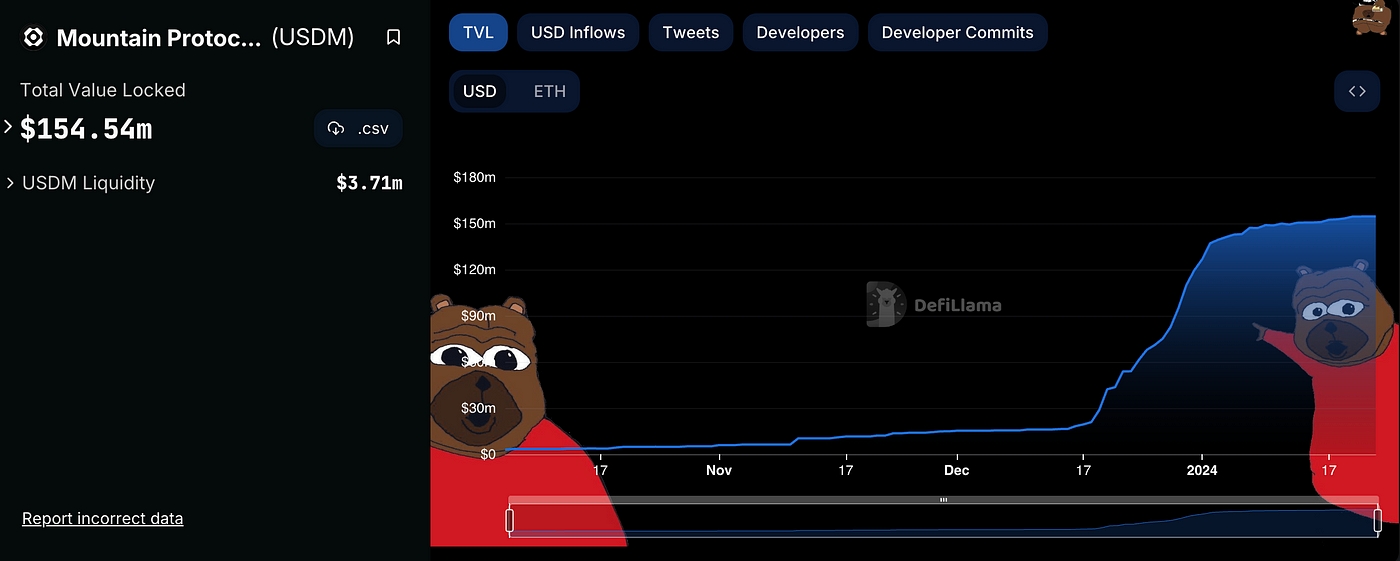

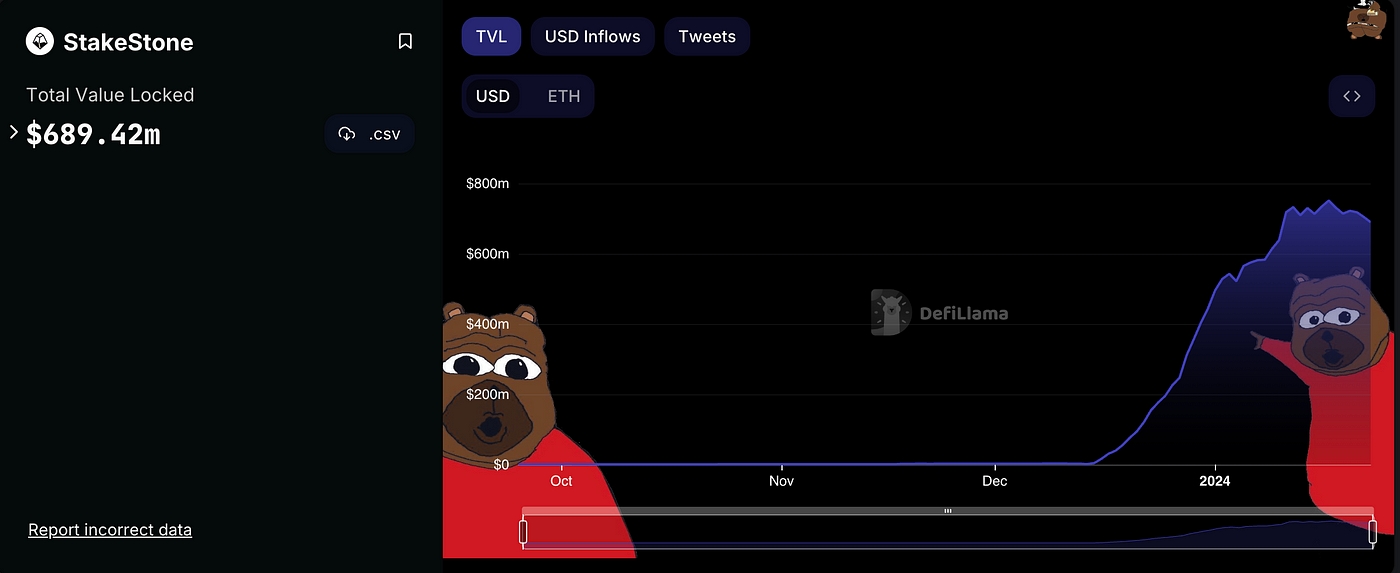

Just like Blast partnered with Lido and Maker as its yield providers, both Mantle and Manta partnered with their respective protocols. Mantle with Ondo Finance (T-Bills). Manta with Mountain Protocol (T-Bills) and StakeStone (LSTs).

These partnerships proved to be kingmakers for small procotols. Mountain Protocol’s TVL 10x’ed with Manta, while Stakestone literally got off the ground from zero.

Mountain Protocol’s hockey stick due to Manta Pacific L2

StakeStone might as well be called Manta Pacific Staked ETH

Manta’s rushed launch

Manta’s “salad of off-the-shelf solutions”, as a private chat puts it lightly, is a high leverage bet on riding narratives. They were the first to airdrop, and first to have a somewhat working product on Celestia.

It was an impressive show of agility, but there were bound to be some botched parts, misalignments, and a couple groups that were promised airdrops but that Manta “missed”.

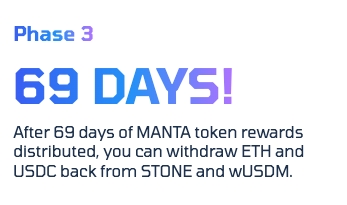

Mid-way during the launch of Manta Pacific, they decided to lock the two yield bearing assets for 69 days as a way to get users to commit to the L2 in return Manta airdrop points (campaign called New Paradigm).

Manta’s Bridge showing the (Old) contracts for the unlocked tokens still show up, as a reminder of how to move fast…

Manta’s Bridge showing the (Old) contracts for the unlocked tokens still show up, as a reminder of how to move fast…

The fact that only STONE (a staked ETH) and wUSDM are locked on the L2 and most assets were free to be withdrawn, meant the locked ones would get an illiquidity discount.

Indeed almost immediately, STONE traded at a discount to ETH as airdrop farmers sold STONE into ETH, bridged out, and bridged back into STONE, and repeat, to get levered servings of Manta airdrop points.

This farming was in vain because from the complaining I gathered from Twitter, the airdrop wasn’t nearly as generous as the farmers expected. Most of the airdrop went to influencers who were able to get people to use their referral code.

EigenLayer looms

In contrast to the yield-bearing L2s, the EigenLayer narrative has been a slow but consistently rising tide. Ever since opening up for deposits, Eigenlayer’s self-imposed deposit limits have instantly filled up every time the limits were raised.

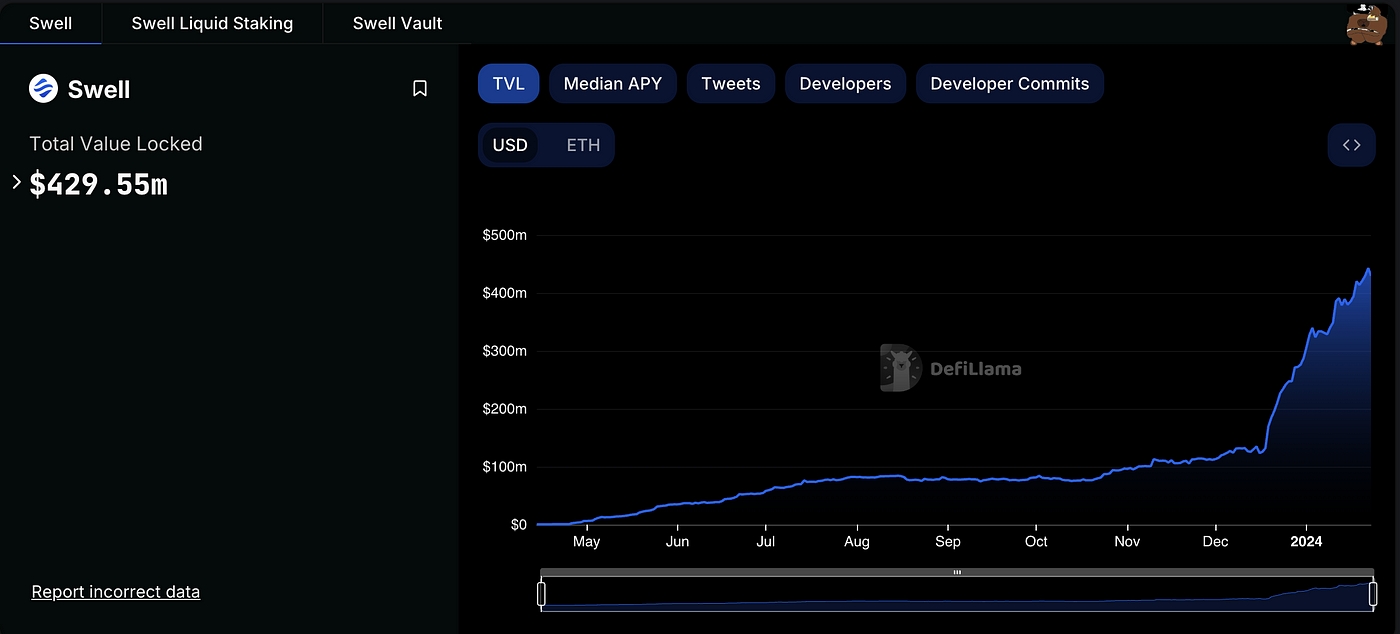

At first limited to only three LSTs (stETH, cbETH, and rETH), Eigenlayer then opened up to new LSTs. This is where Swell Network finally had a breakthrough. They were able to get included in the new set of LSTs, and the demand to farm EigenLayer was so great that it drove TVL into new LSTs.

Really, this is a testament to the grind that Swell has been putting out. They have been setting up partnerships across the board, not only Eigenlayer, with Enzyme, Pendle, Penpie, Sommelier, Maverick, Aura, and more. Not everything moves the needle, but at the same time you don’t know what exactly will give you the 10x growth you need.

The sharp increase in Swell Network’s TVL coincides with Eigenlayer including them in.

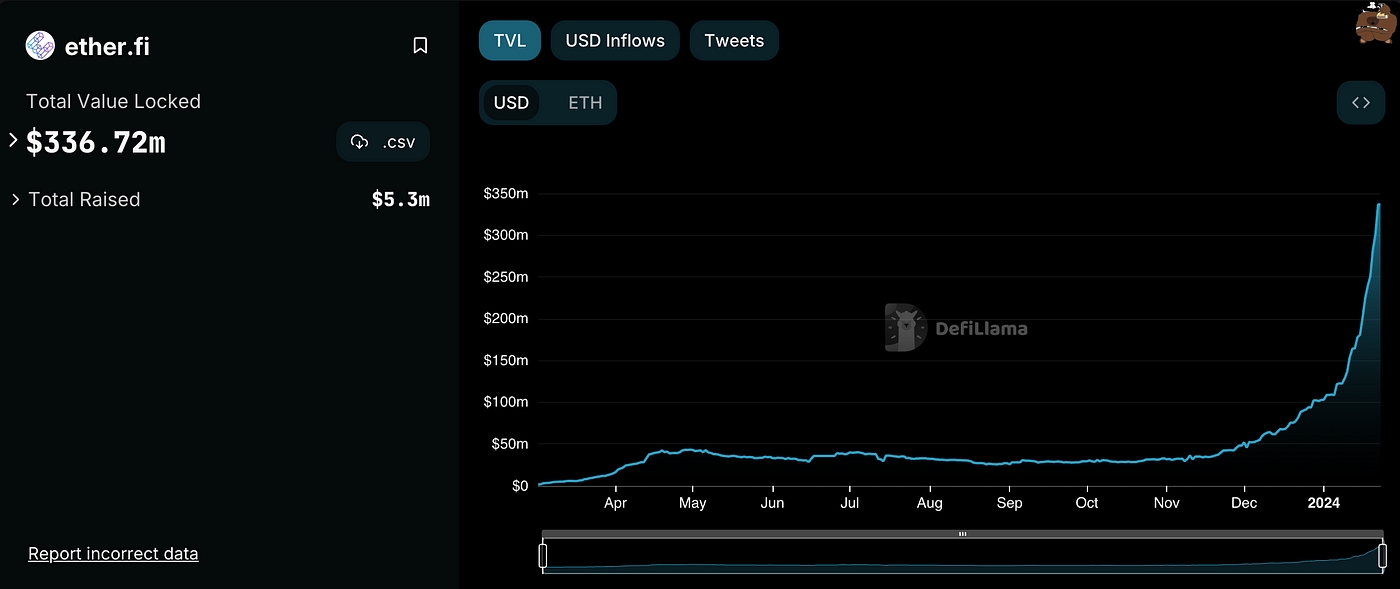

As EigenLayer’s limits for LSTs were reached, attention pivoted to the native restaking option which does not have a limit. Native restaking protocols like Ether.fi opened the doors for anybody who still want to get in on the EigenLayer points. This proved to be an excellent maneuver.

Today, EigenLayer’s TVL stands at over 750k ETH, with only 112k coming from Lido.

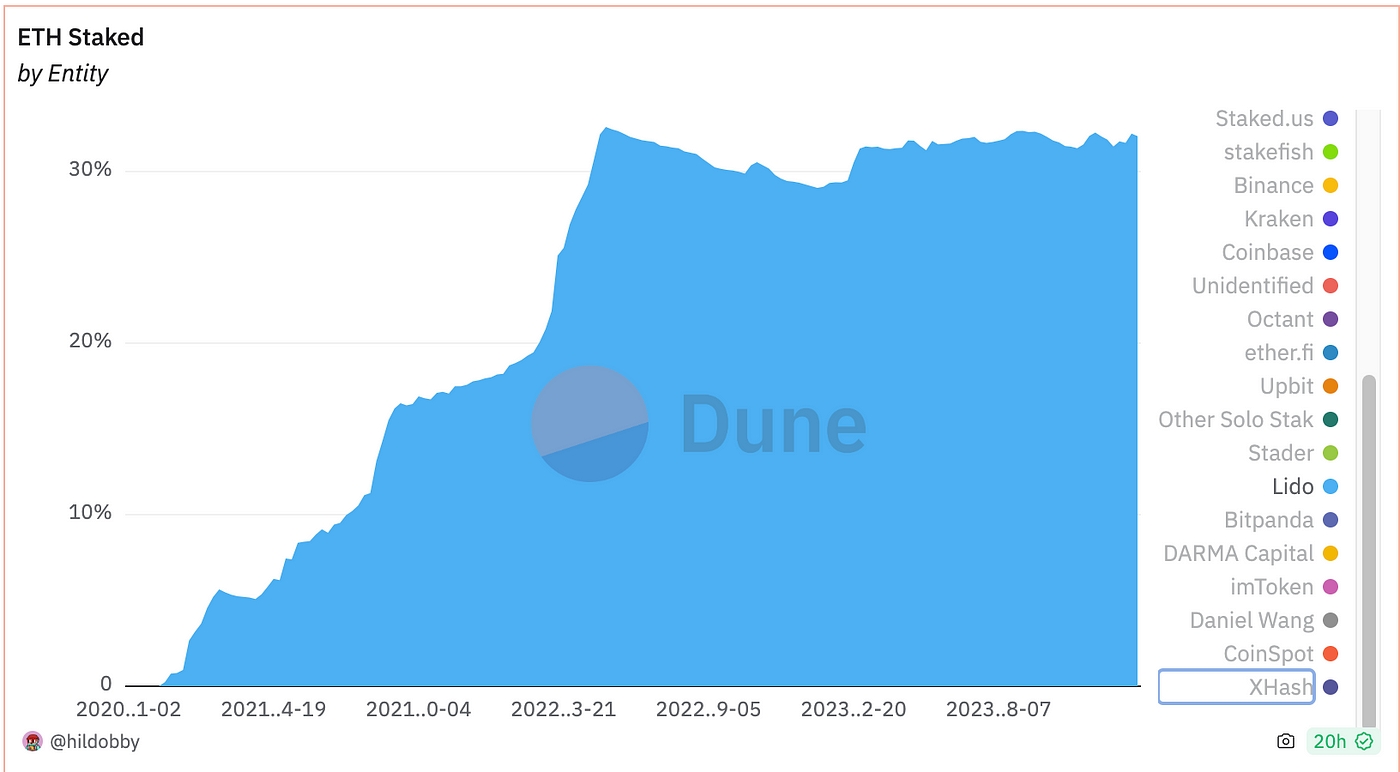

Lido still king?

Despite all these new developments chipping away at Lido, Lido’s share in staked ETH has remained steady at around 31%. However, cracks are forming because an increasing part of that staked ETH is now controlled by entities like Blast and Mantle that have the ability to either switch providers or bring staking in-house.

After the last few months, I don’t think Lido’s dominance on the LST market is unassailable. Non-Lido providers are gaining lindy-ness and liquidity by the day, working hard to steal market share. L2s and restaking changed the landscape.

There are also new protocols that are starting to rally the long tail of the staking market that remain illiquid today. Sanctum on Solana and Tenderize on Polygon and The Graph. They are building a market to bring liquidity all the solo stakers that today don’t have a choice but to wait out the unstaking period. It makes sense because most of the staking risk is gone once the assets enter the unstaking queue. I expect them to soon move to Ethereum to tackle the lion’s share.

Some takeaway

TVL movement is largely a reflection of where the macro sized yield opportunities are, and yield opportunities are reflexive with overall market sentiment. However, it is in those opportune moments that users are the most willing to try new projects, which opens up a window for the pecking order to change.

Work in the background is mostly invisible. Market feedback happens slowly and then all at once, and is very noisy. Try to focus, but also embrace the narratives. Make partnerships, it’s ultimately a co-op game.

More to Read

Fintech RFS

Qiao Wang

·Dec 15, 2025

While it may seem that the low hanging fruit from the digitization of finance has been picked, about half of the world population is still either physical-first or outright unbanked. Furthermore, current technology waves – namely crypto and AI – have the potential to unlock greater value for consumers and businesses.

You're Vibe Coding Wrong

Mohamed Elseidy

·Jul 10, 2025

Most developers use Tier 1 for UX & rapid prototyping, Tier 2 for daily development, and Tier 3 for complex engineering challenges. The best strategy is to combine them when needed rather than trying to force one tool to do everything. Here's what each tier actually delivers and when you should use them

Your Moat Isn't Your AI Prompt. It's Your Evaluations

Mohamed Elseidy

·Jun 17, 2025

Anyone can copy a prompt, but they can't replicate the months of iterative learning, the domain knowledge and the edge cases discovered through real user interactions, and the systematic evaluation framework that guided every prompt tweaking decision.